The Best Guide To Nj Cash Buyers

Table of ContentsNj Cash Buyers for BeginnersExamine This Report on Nj Cash BuyersThe Buzz on Nj Cash Buyers3 Easy Facts About Nj Cash Buyers Shown

The majority of states approve consumers a specific level of protection from financial institutions regarding their home. Some states, such as Florida, entirely exempt the home from the reach of specific creditors. Other states set limitations ranging from just $5,000 to up to $550,000. "That indicates, no matter the value of your home, creditors can not force its sale to please their cases," says Semrad.You can still go into repossession through a tax obligation lien. If you fail to pay your residential property, state, or government taxes, you could lose your home through a tax obligation lien. Acquiring a residence is a lot easier with cash. You don't need to wait for an examination, assessment, or underwriting.

(https://www.resimupload.org/njcashbuyers1)I know that several vendors are much more most likely to accept a deal of money, but the vendor will obtain the cash regardless of whether it is funded or all-cash.

Indicators on Nj Cash Buyers You Need To Know

Today, regarding 30% of US homebuyers pay money for their homes. There might be some excellent reasons not to pay money.

You may have qualifications for an outstanding home mortgage. According to a current research by Money magazine, Generation X and millennials are taken into consideration to be populations with one of the most potential for growth as customers. Handling a little of debt, particularly for tax objectives excellent terms might be a much better choice for your financial resources on the whole.

Possibly purchasing the securities market, common funds or a personal business could be a better option for you in the future. By acquiring a building with cash money, you run the risk of diminishing your get funds, leaving you at risk to unexpected upkeep expenses. Having a home involves ongoing costs, and without a mortgage padding, unanticipated fixings or renovations could stress your finances and hinder your capability to keep the residential property's condition.

Some Ideas on Nj Cash Buyers You Should Know

Home rates fluctuate with the economic climate so unless you're intending on hanging onto your home for 10 to 30 years, you might be better off spending that money in other places. Acquiring a building with cash can speed up the purchasing procedure dramatically. Without the need for a mortgage authorization and linked documentation, the transaction can shut much faster, offering an affordable side in competitive property markets where vendors might choose cash customers.

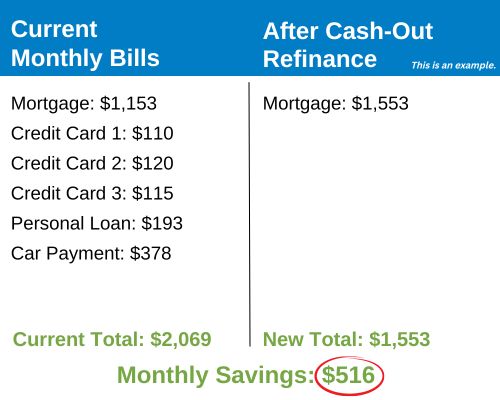

This can lead to substantial cost financial savings over the long-term, as you will not be paying passion on the loan amount. Money purchasers commonly have stronger negotiation power when managing sellers. A cash money offer is extra appealing to vendors considering that it reduces the risk of an offer dropping through due to mortgage-related issues.

Bear in mind, there is no one-size-fits-all service; it's vital to customize your choice based on your private conditions and long-term aspirations. Prepared to begin looking at homes? Provide me a telephone call anytime.

Whether you're liquidating possessions for a financial investment building or are diligently saving to buy your desire home, getting a home in all cash can significantly increase your buying power. It's a tactical step that enhances your setting as a buyer and improves your flexibility in the real estate market. However, it can put you in a financially susceptible place (cash for homes companies).

6 Simple Techniques For Nj Cash Buyers

Conserving on rate of interest is one of one of the most typical reasons to buy a home in cash money. Throughout a 30-year home loan, you can pay 10s of thousands and even hundreds of hundreds of dollars in overall rate of interest. Furthermore, your buying power increases without any funding backups, you can explore a broader choice of homes.

Property is one financial investment that has a tendency to exceed rising cost of living with time. Unlike supplies and bonds, it's considered less risky and can provide short- and long-term wealth gain. One caveat to note is that during specific economic markets, genuine estate can create less ROI than various other investment types in the short-term.

The greatest risk of paying money for a home is that it can make your financial resources unstable. Binding your liquid properties in a home can minimize financial flexibility and make it extra tough to cover unforeseen expenses. Additionally, binding your money implies losing out on high-earning financial investment chances that could produce higher returns elsewhere.